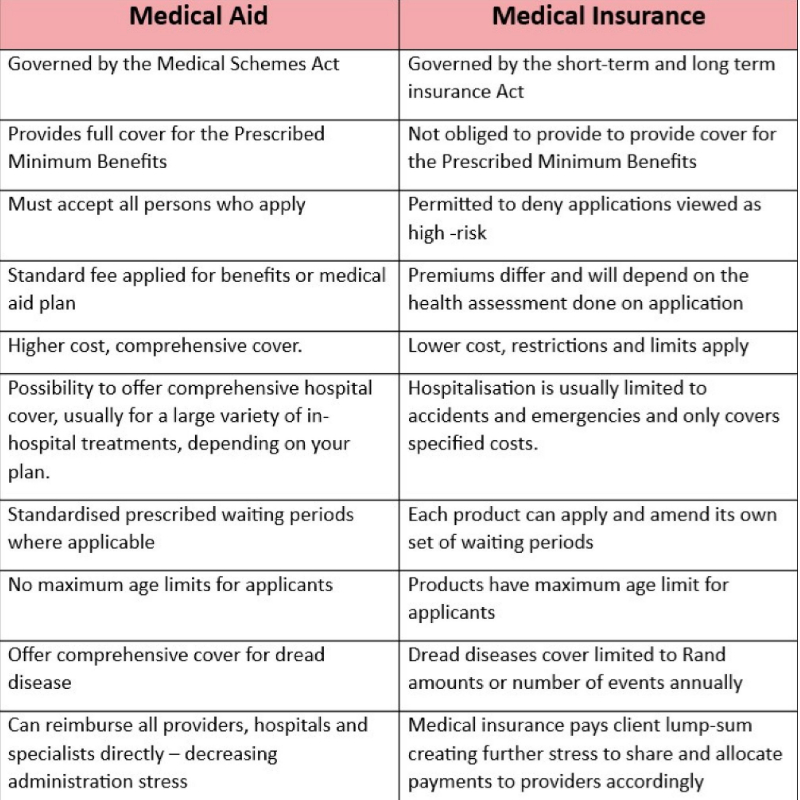

| Knowing the difference between a medical aid versus medical insurance plays a crucial role in managing your health especially in times of an emergency. Many members perceive the product offerings similar in terms of benefits, but on closer review, there is a vast difference in the type of medical cover provided by each. Being aware of significant advantages and disadvantages can prevent any confusion experienced by the consumer and pre-empt the risk of unnecessary costs with minimum cover in instances when suitable health cover is most needed. The contrast in the offerings from a medical aid scheme and a medical insurance plan is noted mainly in the cost and benefit offerings, types of cover as well as chronic and hospital cover. Medical Aid schemes are regulated by the Medical Schemes Act, and therefore by law are held accountable to abide by a list of rules and regulations, cost structures as well as offer cover for a set list of prescribed minimum benefits. Prescribed Minimum Benefits (PMB) is a set of defined benefits to ensure that all medical scheme members have access to certain minimum health services, regardless of the benefit option they have selected. PMBs are a feature of the Medical Schemes Act, in terms of which medical schemes have to cover the costs related to the diagnosis, treatment and care of any emergency medical condition; a set of 270 medical conditions; and 25 chronic conditions defined in the Chronic Diseases List (CDL). Medical Insurance plans, on the other hand, are governed either by the short-term or long-term insurance Act and not by medical aid regulations. This policy allows insurance plans not to provide cover for specific treatment plans or PMB’s but alternatively provides a lump sum for a set of defined risks. In the case of hospital cover, medial insurance providers could package options that exclude or limit private hospital cover and opt to pay for day to day costs only when a designated network of service providers are used. Further notable differences are that a medical aid scheme must accept any persons who apply and may not discriminate in terms of income or family size. Applicants may be subject to specific waiting periods and provisional exclusions depending on pre-existing conditions and plans. In a comparative view, a health insurance company may refuse to cover an individual if they consider that the risk of claiming is too high. Low-cost Health insurance options became popular in South Africa due to the perception of low-income earners not being in a position to afford full medical aid cover. While monthly premiums might seem more affordable, members should weigh up individual healthcare needs, risks and long-term unforeseen expenses. Affordable healthcare options are tailor-made to the client’s needs and budget, and therefore, medical aid plans seem costlier but do offer comprehensive healthcare benefits. There are also options to have health insurance in combination with a medical aid plan to complement or counteract any limitations on either option. To find the best healthcare solutions for you and your family, view the tabled comparisons between medical aid and medical insurance options that you could discuss with a Glopin Healthcare Consultant to inform your decisions when investing into your health. |